Think of an HPI trade check as a vehicle's professional CV. It’s the full, unvarnished story of its financial and service history, and for any dealer, it’s the absolute first step you should take before even thinking about adding a new car to your stock. This isn’t just about ticking a box; it’s about protecting your investment, your reputation, and your legal standing with a report that goes miles deeper than what a retail customer sees.

Why the HPI Trade Check Is Your First Line of Defence

The UK’s used car market moves fast, and every single vehicle you consider buying comes with risk. That perfect-looking motor could be hiding a dirty secret—outstanding finance, a clocked mileage, or worse, it could be stolen. For a dealership, these aren't just headaches; they’re landmines that can blow up your bottom line and shatter the trust you've built with customers. This is precisely why an hpi trade check is your most valuable tool.

It’s the difference between a quick glance and a proper forensic investigation. A private buyer might get by with a basic consumer check, but as a professional trader, you need far more detail to make smart, profitable decisions. A trade-specific report from a service like AutoProv gives you the solid intelligence you need to operate safely and successfully.

Protecting Your Investment and Reputation

Every car on your forecourt represents a hefty financial outlay. A professional vehicle history check is your insurance against buying a problem car that could lead to huge losses, legal battles, or damage to your hard-won reputation. It digs up the critical details that a visual inspection and a test drive simply can't.

For a motor trader, skipping a comprehensive vehicle check is like a builder laying foundations without surveying the ground. You might save a small amount upfront, but the potential cost of collapse is immense. The check is your blueprint for a secure and profitable purchase.

The Modern Approach to Vehicle Intelligence

In today's market, relying on gut feelings or incomplete data is a surefire way to get burned. The speed and accuracy of your due diligence process directly impact whether you snag the best stock or get stuck with cars that won't sell. The game now demands instant, reliable, and commercially-focused information.

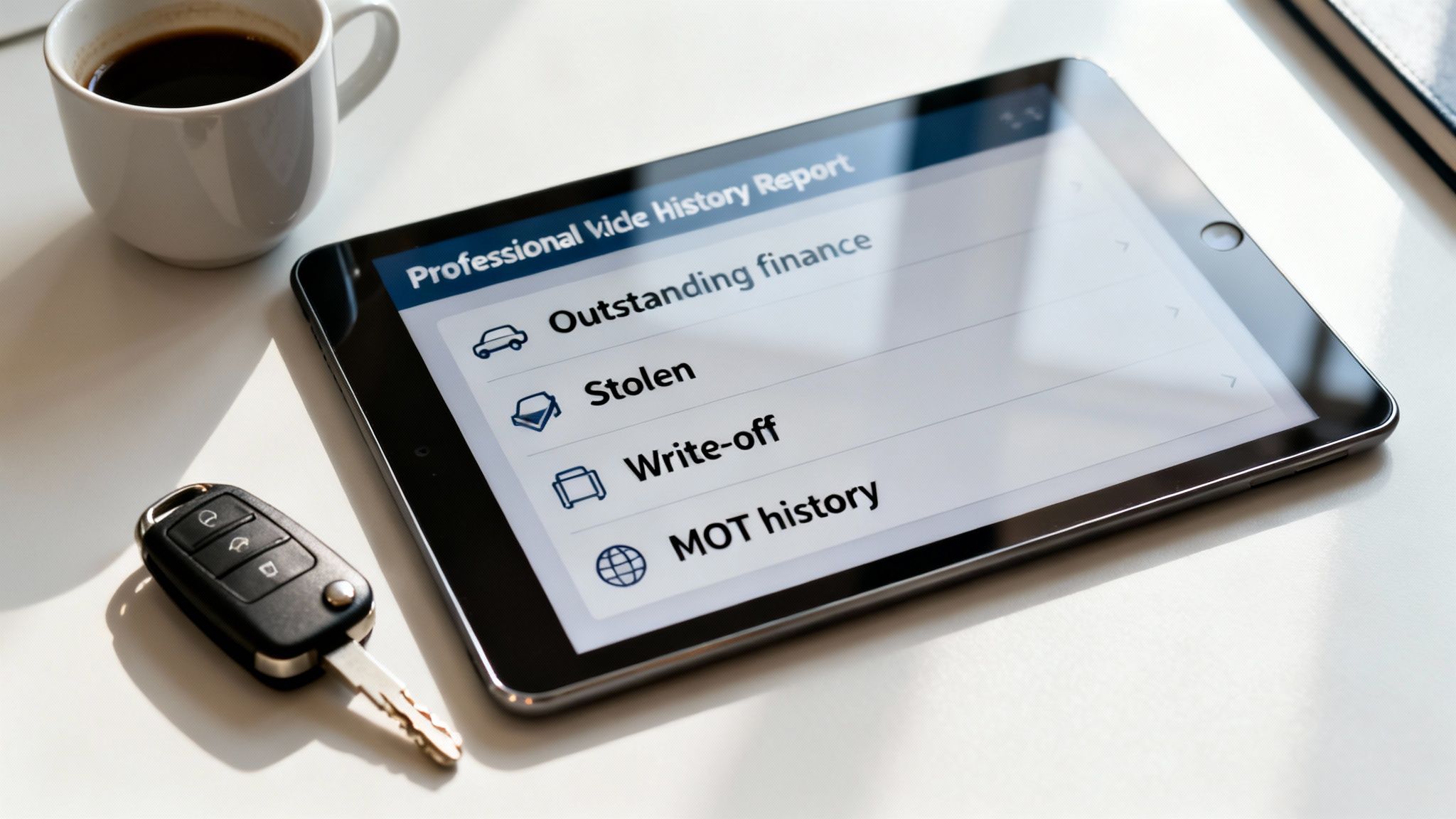

Modern platforms are built to feed this intelligence right into your daily workflow. Forget basic history; they provide a complete picture of a vehicle's provenance and its real-world commercial viability. This includes crucial data points such as its financial status, confirming instantly if there is outstanding finance. It also uncovers condition history, revealing if a vehicle has been declared a write-off, and cross-references police records to verify if the car has been reported as stolen. Beyond this, advanced services provide commercial insights, accessing data that impacts a vehicle's value and desirability.

For a deeper dive into how these reports function in a trade environment, check out our HPI checks for traders in our practical guide. Solutions like AutoProv deliver this critical intelligence in seconds, empowering you to make confident, profitable decisions on every single vehicle.

What a Professional Vehicle History Report Reveals

To make consistently profitable decisions, you need to get under the bonnet of a vehicle's past and really understand its story. A professional HPI trade check isn’t just a dry list of facts; it’s a narrative that reveals a car's journey, its financial baggage, and any hidden trauma that could come back to bite your dealership.

To make consistently profitable decisions, you need to get under the bonnet of a vehicle's past and really understand its story. A professional HPI trade check isn’t just a dry list of facts; it’s a narrative that reveals a car's journey, its financial baggage, and any hidden trauma that could come back to bite your dealership.

Think of it as peeling back layers of paint to see the true state of the metal underneath.

The first and most critical layer of any reliable report covers the absolute fundamentals of risk. These are the non-negotiables, the deal-breakers that protect you from immediate financial loss and legal nightmares. They form the core of your due diligence and are the very first things any seasoned trader scans for.

Foundational Pillars of a Trade Check

The biggest threats to your bottom line are often hidden in plain sight, logged away in national databases. A professional check is your direct line to this crucial information, throwing up major red flags before you even think about putting money down.

A comprehensive check verifies outstanding finance agreements, which is the number one cause of financial loss for dealers. A report confirms if a vehicle is still legally the property of a finance company, stopping you from buying a car that could be repossessed right off your forecourt. It also cross-references police stolen vehicle records from the Police National Computer (PNC), ensuring the vehicle hasn't been reported stolen and protecting you from the serious legal trouble of handling illicit goods. Finally, it flags the insurance write-off history, identifying if a car has been declared a total loss (e.g., Cat S or Cat N), which can torpedo its resale value.

These three checks alone can save you from catastrophic buying mistakes. For a professional trader, though, this is just the opening chapter.

Digging Deeper for Hidden Issues

The real difference between good stock and bad often lies in the subtler details. This is where you uncover the less obvious—but equally costly—problems like vehicle cloning, mileage fraud, and suspiciously high owner turnover.

Verifying the car's registration details against DVLA records is your frontline defence against cloned cars, where criminals slap the identity of a legitimate vehicle onto a stolen one. In the same way, a sharp analysis of the MOT history is your best tool against clocking. Look for gaps in testing, weird mileage jumps between tests, or a long list of failures; these can all point to a tampered odometer.

A car's history is written in its data. Discrepancies in mileage, frequent keeper changes, or gaps in its MOT record are the footnotes that tell you the real story—one that a seller might not want you to read.

Finally, the report confirms the number of previous keepers. A high turnover of owners on a relatively new car should set alarm bells ringing. It often points to a persistent, nagging issue that previous owners simply gave up on trying to fix. Getting to grips with this data is vital, and you can explore this further in our guide on the essential used car history report for dealers.

The Advanced Intelligence That Drives Profit

While legacy checks cover the basics, modern platforms like AutoProv deliver an extra layer of commercial intelligence. This helps you not just sidestep risk, but actively spot profitable opportunities. This is where a standard check runs out of road and a true trade-focused tool takes over.

This advanced data includes alerts for previous use as a private hire or taxi vehicle, which strongly suggests higher-than-average wear and tear. It also gives you access to manufacturer recall data across dozens of brands, making sure you aren't buying a vehicle with an outstanding safety issue that will become your problem to sort.

By layering these foundational checks with deeper analysis and advanced commercial insights, you build a complete, 360-degree picture. Each piece of data helps you accurately assess a vehicle’s true condition, its market value, and its overall risk profile. It’s how you turn every purchase into a calculated, confident, and profitable decision.

The Critical Difference Between Trade and Consumer Checks

Relying on a consumer vehicle check for a professional trade purchase is a bit like using a tourist map to navigate a complex delivery route. It shows you the main roads, sure, but it misses all the critical details—the low bridges, the one-way systems, the loading bays—that you actually need to do your job properly. For a motor trader, the gap between a report built for the public and a tool built for the industry isn't just a minor detail; it's the foundation of a safe, profitable deal.

A private buyer is mostly worried about one thing: not buying a lemon. Their check is designed to give simple, direct answers. Is it stolen? Is it a write-off? Does it have outstanding finance? A trade check answers these questions too, but it understands that for a dealership, the whole context is commercial. The stakes are much higher, the risks are far more varied, and you need that information instantly.

Deeper Data for Professional Decisions

The biggest difference comes down to the sheer depth and breadth of the data you get. A consumer report is a snapshot; a professional hpi trade check is a full diagnostic. It’s built to answer not just "Is this car safe to buy?" but the more important question: "Is this car a profitable asset for my business?"

This means digging much deeper than the basics to flag up trade-specific risks. For instance, a consumer check probably won't tell you if a vehicle has a history as a taxi or private hire vehicle. For a dealer, that's crucial information. It points to significantly higher wear and tear, which has a direct knock-on effect on the car's longevity, potential workshop costs, and what you can realistically sell it for.

Financial Indemnity and Commercial Risk

Another massive differentiator is the level of financial protection—the indemnity—that comes with the report. Consumer checks often have a very limited financial guarantee, if any at all. For a business buying and selling dozens of cars a month, that kind of exposure is just not commercially viable.

A consumer check protects a single transaction. A trade check protects your entire business. The indemnity backing a professional report is your financial safety net, safeguarding your capital against hidden title issues that could wipe out your profit.

Trade-grade reports come with substantial indemnity guarantees, often scaling up to tens of thousands of pounds. This protection acknowledges the serious financial risk dealers take on with every single purchase. It’s a clear sign that the data is robust enough for commercial use, guaranteeing you against losses from nasty surprises like undisclosed finance agreements. Trying to save a few quid on a cheaper, non-indemnified report is a false economy that can leave your dealership open to a catastrophic financial hit.

From Basic History to Market Intelligence

Perhaps the most important shift in modern trade checks is the move towards including real commercial intelligence. A consumer report tells you about the car's past. A professional platform like AutoProv tells you about its present value and future potential. This means adding critical commercial data points that you simply won't find in consumer-level products. These include live market valuations, giving you real-time trade and retail pricing data to ensure you never overpay for stock and can price it smartly. They also provide depreciation analysis to gauge long-term value and desirability metrics that show how quickly a specific model is selling, helping you prioritise profitable stock.

This commercial layer transforms a simple history check into a powerful decision-making tool. It helps you buy smarter, price more competitively, and turn your inventory over faster. Skimping on a trade-specific check also puts you on shaky ground with your legal duties. To get a better handle on your responsibilities when selling to the public, it's worth reviewing your obligations under the Consumer Rights Act 2015 for the UK motor trade. Put simply, the data from a proper trade check is your best line of defence.

How Legacy Data Costs Are Squeezing Your Margins

In the motor trade, every single pound counts. While you're busy focusing on the big numbers—buying price, prep costs, sales margins—a silent expense is often eating away at your profit on every single car you handle: the cost of your data. A professional hpi trade check is non-negotiable, but relying on legacy providers with outdated, inflated pricing models is turning this vital due diligence tool into a serious financial drain.

For too long, the industry standard has been built around high per-check fees. These costs, often shrugged off as just another business expense, quietly stack up. Before you know it, they've put a significant squeeze on the already tight margins of a modern dealership. When you're processing dozens or even hundreds of vehicles a month, those seemingly small fees quickly snowball into a major overhead.

This financial pressure forces a difficult choice. Do you absorb the high costs and watch your profit per unit shrink, or do you risk skipping checks on certain cars and expose your business to catastrophic losses? Neither option is sustainable in the long run.

The Real-World Cost of Outdated Pricing

Let's break down the economics. The financial hit from these legacy systems isn’t some abstract concept; it's a tangible loss that shows up on your balance sheet, month after month. The difference between an old-school pricing model and a modern, trade-focused platform is staggering when you actually look at the numbers.

In the UK motor trade, this has become a critical issue for used car dealers. Traditional CAP HPI trade checks can sting you for anywhere between £9.99 and £19.99 per report. This means a small independent dealer running 100 checks a month could easily be spending up to £2,000 on provenance data alone. In sharp contrast, modern trade-focused platforms like AutoProv offer checks from as little as £2.00, slashing that monthly bill to around £200. That's a potential saving of up to 90%.

This cost pressure is especially acute when UK used car retailers are working on net margins of just 3–5%. Spending an extra £10 per car on data can wipe out a huge chunk of your profit, particularly on lower-value stock. Find out more by reviewing the cost analysis of HPI trade check alternatives.

This isn't just about saving a bit of cash; it's about reallocating your capital to where it actually matters.

Reinvesting Savings into Growth

The savings you make by switching to a cost-effective provider aren't just numbers on a spreadsheet. That capital can be put straight to work to actively grow your business and strengthen your competitive position.

Every pound saved on data is a pound you can reinvest directly into your dealership's future. It's the difference between merely surviving on thin margins and actively thriving by building a more resilient, profitable operation.

Think about what thousands of pounds in annual savings could do for your dealership. It could give you the cash flow to acquire more stock, especially when you spot a great opportunity at auction. It could fund a new digital marketing campaign to drive more footfall to your forecourt and generate more leads. You could also invest in better workshop equipment or improvements to your customer-facing areas. Finally, it gives you more flexibility in your pricing, allowing you to be more competitive. You can learn more about how data influences this in our guide to market insights and vehicle pricing.

The message is clear: you no longer have to accept overpaying for essential vehicle intelligence. Platforms like AutoProv are designed for the economic realities of today's motor trade, providing the comprehensive data you need at a price that protects, rather than penalises, your profit margins.

How to Read a Report and Spot Costly Red Flags

A vehicle provenance report is more than just a list of facts; it’s a story. Sure, the big headlines like 'Stolen' or 'Outstanding Finance' jump off the page, but the real money is made or lost in the details. Learning to read between the lines of an hpi trade check is what separates the pros from the amateurs, protecting your margins from nasty surprises down the line.

A vehicle provenance report is more than just a list of facts; it’s a story. Sure, the big headlines like 'Stolen' or 'Outstanding Finance' jump off the page, but the real money is made or lost in the details. Learning to read between the lines of an hpi trade check is what separates the pros from the amateurs, protecting your margins from nasty surprises down the line.

The obvious red flags are designed to be unmissable. But the subtle clues—the ones buried in the MOT history or keeper records—are where the real detective work begins. These are the hints that point to a car with a troubled past or underlying mechanical gremlins that a quick polish won't fix.

Analysing the MOT History for Hidden Truths

Think of the MOT history as a car's medical records. It’s one of the most revealing sections of any trade check, but you have to look beyond a simple pass or fail. It’s a year-by-year log of the vehicle's health, and strange patterns can give the game away on everything from neglect to outright mileage fraud.

You're not just looking for failures; you’re hunting for trends. A long list of advisories on a relatively new car is a huge red flag. If you see the same issues popping up year after year—like suspension wear or brake problems—it suggests the car has either been driven hard or the owner has been bodging repairs. Either way, those are future garage bills with your name on them.

An MOT history isn’t just a record of tests; it’s a vehicle’s medical chart. Consistent advisories for the same component are like a chronic condition, signalling an expensive problem that previous owners likely couldn’t, or wouldn't, fix properly.

Mileage discrepancies are another classic sign of trouble. Keep an eye out for any inconsistencies, like a sudden drop in recorded mileage between tests or unusually few miles added over a year. This is a tell-tale sign of clocking, a practice that artificially inflates a car's value while hiding its true level of wear and tear.

Understanding Write-Off Categories

Write-off categories are one of the most misunderstood parts of a vehicle check. It's not enough to see a car has been written off; you need to know exactly what the category means for its safety, its value, and your ability to shift it on the forecourt.

The two main categories you’ll come across are Category S and Category N. Category S (Cat S) means the vehicle has suffered structural damage but has been deemed repairable. The key word here is structural; it needs a professional, top-quality repair to be made road-safe again. Category N (Cat N) points to non-structural damage, where the issue might have been cosmetic or electrical, but the car's core frame and chassis were untouched.

While a Cat N car might sound like a safer bet, any write-off history is going to hit its resale value and put some retail buyers off. You absolutely have to factor this into your buying price and be ready to explain it clearly to customers. A flagged vehicle isn't always a deal-breaker—in fact, it can be a great negotiation tool—but you have to go in with your eyes wide open.

Spotting Keeper Change Anomalies

Finally, pay close attention to the number of previous keepers. A high turnover of owners in a short space of time is a classic warning sign. More often than not, it points to a persistent, niggling fault that owner after owner has failed to fix before giving up and moving it on.

This is where a service like AutoProv really shines. It's designed to pull all these details out of the data and put them right in front of you in a clear, easy-to-read format. You can see MOT advisories, write-off markers, and keeper history at a glance, turning a dense hpi trade check from a research project into a quick, confident risk assessment. It means you spend less time digging for clues and more time buying the right stock at the right price.

Integrating Provenance Checks into Your Buying Workflow

Having the best data is one thing. Actually using it effectively is what protects your margins and makes you money. The most powerful hpi trade check is completely useless if it’s clumsy or slows you down when you need it most.

To get a real edge, you have to embed instant provenance checks right into your daily buying routine.

Whether you're standing in a windy auction hall, appraising a part-exchange on the forecourt, or on a private seller's driveway, speed and certainty are everything. The days of scribbling a reg number on your hand to check back at the office are long gone. By the time you do that, your competitor has already run a report on their phone, confirmed the car is clean, and shaken hands on the deal.

Modern tools are built for this fast-paced world. Having a platform like AutoProv on your phone or tablet totally changes the buying process, turning a clunky, multi-step chore into a single, seamless action.

Making Immediate Data-Backed Decisions

Instant access means you can make confident decisions on the spot, backed by hard data, not just gut instinct.

Think about this common scenario: a customer wants to part-exchange their vehicle. With a mobile-first platform, you run a full trade check right there with them. Within seconds, you know its complete history – finance, write-offs, keeper changes, the lot. This puts you in an incredible position of strength.

Integrating instant checks into your appraisal process isn't just about efficiency; it's about control. You can immediately spot any undisclosed issues and use that information to negotiate from a position of authority, ensuring you pay the right price for every single vehicle.

This doesn't just stop you from overpaying for a car with a dodgy past; it also shows a level of professionalism that builds serious trust with your customers.

Connecting a Streamlined Workflow to Profitability

This streamlined approach has a direct, measurable impact on your dealership’s bottom line. When your due diligence is instant, you can assess and snap up the best stock before competitors even get their reports back. It’s a simple formula: better quality inventory leads to a faster stock turn.

A slicker, more efficient buying process leads directly to better margins by avoiding costly mistakes and negotiating sharper prices. It also results in an improved stock turn as you buy cleaner, more desirable vehicles, slashing the time they spend on the forecourt. This combination of better margins and faster sales equals significant financial growth and higher overall profitability.

This is absolutely critical in today's market. Pricing and risk in the UK used car sector are tightly linked to wider economic trends, making solid checks a strategic necessity. With CPI inflation running at 3.2–3.5% and households feeling the squeeze, price sensitivity on cars in the £8,000–£18,000 bracket is razor-sharp.

It's in this exact price range where an undisclosed finance agreement or a write-off status can cause the biggest financial headache for a dealer. You can review the government's data on the UK House Price Index and economic indicators to get a feel for these pressures.

In this climate, an efficient workflow powered by a robust data platform isn't a luxury; it's essential for survival and growth. This efficiency also extends beyond buying, as we explore in our guide to UK vehicle inventory management software. By weaving an hpi trade check seamlessly into your process, you build a faster, smarter, and more profitable dealership from the ground up.

Your Questions Answered on HPI Trade Checks

To round things off, let's tackle some of the most common questions that come up in the trade about HPI checks. This quick-fire section is designed to give you clear, no-nonsense answers that reinforce what we’ve already covered.

Is an HPI Check a Legal Requirement for Dealers?

No, there isn't a specific law in the UK that says you must run an HPI check before selling a car. But don't let that fool you. Under the Consumer Rights Act 2015, you are legally on the hook to ensure any vehicle you sell is of satisfactory quality, fit for purpose, and exactly as you've described it.

Trying to sell a car with a hidden finance agreement or an undisclosed write-off history would put you in direct breach of those rules. So, while it's not mandated by law, a thorough check is your essential due diligence. Think of it as your best line of defence against costly legal claims and a fundamental part of running a professional operation.

What Is the Single Biggest Risk a Check Protects Against?

Without a doubt, the most common and financially devastating risk is outstanding finance. It's a different beast entirely from a write-off, which simply affects a car's value. An unresolved finance agreement means the car doesn't legally belong to the person trying to sell it to you.

If you buy that car, the finance company can—and will—repossess it at any time. You'll be left with nothing: no car and no money. It's a complete and total loss of your investment.

While issues like mileage discrepancies or previous accident damage can chip away at your profit margin, outstanding finance can wipe out your entire capital outlay on a vehicle in an instant. It is the number one financial threat a trade check is designed to eliminate.

How Quickly Can I Get a Full Trade Report?

Modern platforms are built for the fast pace of the motor trade. With a tool like AutoProv, you can get a complete, comprehensive trade report sent straight to your phone or tablet in under 30 seconds.

This kind of speed is crucial for making confident decisions on the spot, whether you're battling it out at an auction or appraising a part-exchange on your own forecourt. It means your due diligence process never becomes a bottleneck for your business.

Frequently Asked Questions

AI-Generated Content Notice

This article was created with the assistance of artificial intelligence technology. While we strive for accuracy, the information provided should be considered for general informational purposes only and should not be relied upon as professional automotive, legal, or financial advice. We recommend verifying any information with qualified professionals or official sources before making important decisions. AutoProv accepts no liability for any consequences resulting from the use of this information.

Related Articles

Essential Vehicle Checks Before Buying a Used Car

Learn essential checks to ensure your used car purchase is safe and sound in the UK market.

Why a Provenance Check is Essential for Used Car Buyers

Ensure your used car is a smart investment by understanding the importance of a provenance check and how AutoProv can help.

A Guide to Vehicle Check with VIN Number

A vehicle check with vin number is easily the most important thing you can do before buying a used car. Think of it as your first line of defence—a quick, simple step that pulls back the curtain on a vehicle's past, protecting you from expensive mistakes, legal headaches, and downright dangerous cars.

Published by AutoProv

Your trusted source for vehicle intelligence