If you've ever bought or sold a car in the UK, you've definitely come across the V5C. It's often just called the 'log book', and it’s the official Vehicle Registration Certificate issued by the DVLA.

If you've ever bought or sold a car in the UK, you've definitely come across the V5C. It's often just called the 'log book', and it’s the official Vehicle Registration Certificate issued by the DVLA.

This document is proof that a vehicle is registered with the DVLA. Crucially, it also identifies the person or company responsible for taxing the car and making sure it's road-legal. One thing to get straight from the start: the 'registered keeper' named on the V5C isn't necessarily the legal owner.

Your Essential Guide to the V5C Log Book

Whether you’re a private buyer looking for your next runaround, a seller trying to do things by the book, or a seasoned motor trade pro, getting your head around the V5C is non-negotiable.

Think of it as the vehicle’s passport. It holds all the vital statistics needed for it to be legally driven on UK roads. Every single legally registered vehicle has one, and it details everything from its make, model, and engine size to its colour and unique Vehicle Identification Number (VIN).

For anyone buying a second-hand car, checking this document properly is one of the most important first steps. It’s your best tool for confirming the car's identity and checking its history lines up. You can find more practical tips like this in our complete used car buying guide for the UK.

Here's a common trip-up: many people think the V5C proves ownership. It doesn't. It only identifies the registered keeper—the person responsible for the car's admin. Legal ownership is usually proven with a bill of sale or an invoice.

For car dealerships, the V5C is the bedrock of every compliant and efficient sale. The data packed into this single document fuels everything, from running initial vehicle checks to creating accurate online adverts that attract the right buyers. This is where AutoProv's intelligent platform really comes into its own, helping dealers cut through the complex admin tied to every vehicle's paperwork. It ensures total accuracy from the moment a car is acquired to the second it's sold.

How to Read a V5C Section by Section

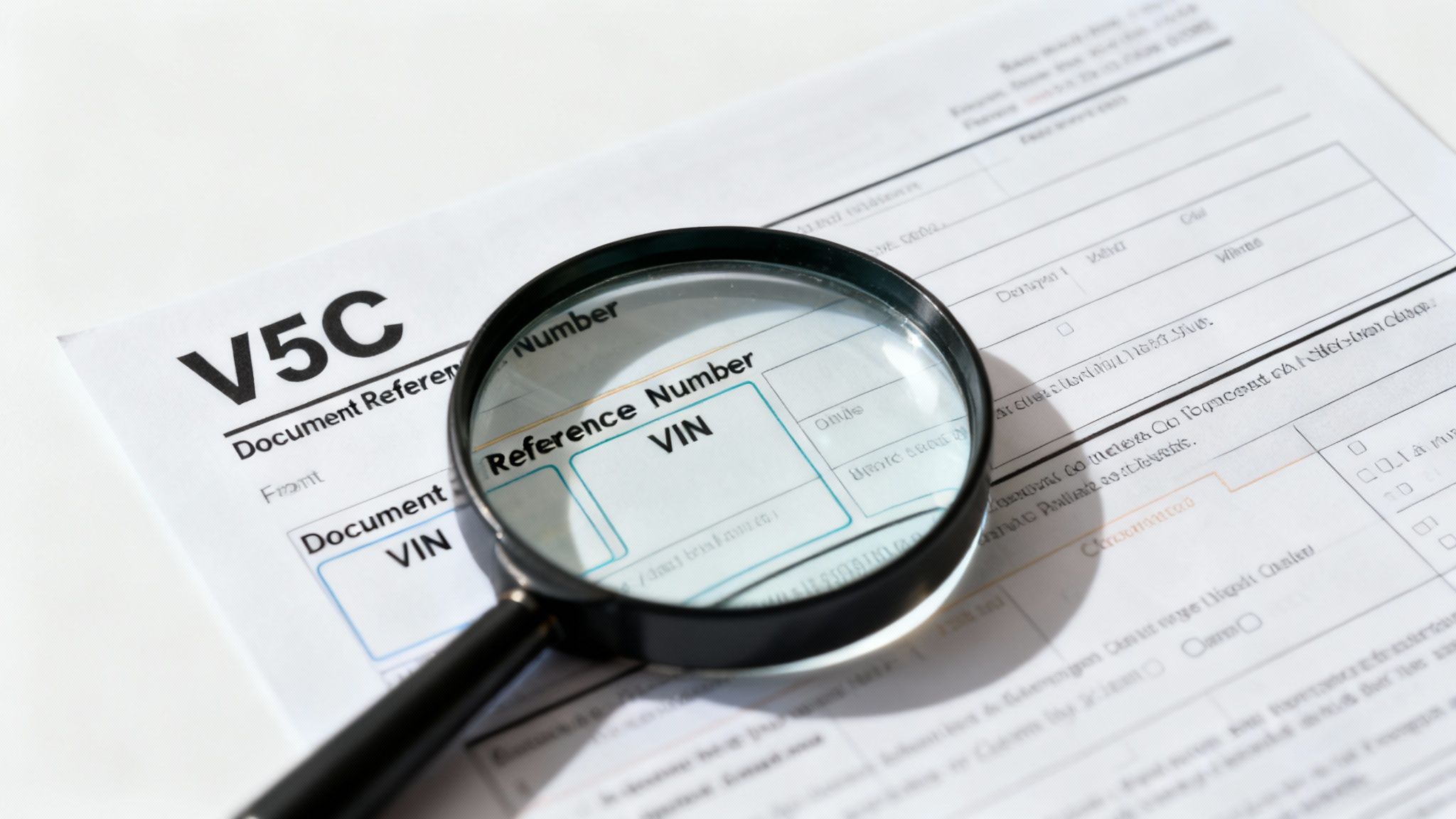

At first glance, the V5C log book can look like a confusing jumble of official codes and boxes. But it’s actually quite straightforward once you know where to look. Think of it as the car’s passport, with the most critical details right on the front.

The front page is your first port of call. It holds the Document Reference Number, a unique 11-digit code you'll need for any online DVLA services, like taxing your car or telling them you've sold it. You’ll also find the date of first registration and the current registered keeper's details. For any buyer, this is the first checkpoint – does the keeper's information match the person selling the car?

Decoding the Vehicle Details Inside

Open up the V5C and you’ll find the vehicle's core identity. This is the nitty-gritty stuff that confirms the car is exactly what the seller claims it is. You’ll want to pay close attention to a few key fields.

- Section 4: This is where you’ll find the main vehicle details. Check the registration number, make, model, colour, and engine size (CC).

- VIN/Chassis Number: The Vehicle Identification Number is like the car’s unique fingerprint. It’s absolutely vital to check that the number on the V5C matches the one stamped on the vehicle itself. Our guide offers more detail on how to use a vehicle's chassis number for these checks.

- Engine Number: A quick check here confirms the engine fitted is the original one registered to the car, which is a big tick in the box for vehicle authenticity.

- Tax Class: This tells you which Vehicle Excise Duty (VED) category the car falls into, such as ‘Private/Light Goods’.

For a motor trade professional, this raw data is the lifeblood of their business. Every single piece of information, from the VIN right down to the CO2 emissions figure, is a vital component in valuing, verifying, and marketing a vehicle properly.

This is exactly the kind of information a platform like AutoProv is built for. It takes this raw data straight from the V5C and transforms it into accurate, compelling, and error-free vehicle adverts. What was once a manual, time-consuming job becomes an automated workflow, ensuring every car is presented to potential buyers with total precision and saving dealership staff hours of work.

The V5C's Role When Buying and Selling a Car

When a car changes hands, the V5C is at the very heart of the transaction. A vehicle sale can live or die by how this document is handled. Whether you're a private seller offloading your old runaround or a seasoned dealer shifting stock, getting this part right is crucial for a smooth, legally sound transfer of keepership.

If you’re the seller, the responsibility falls squarely on your shoulders. You need to fill in the new keeper’s details in the right section of the V5C, sign it, and post the main part straight to the DVLA. Don't delay. This simple action officially tells them you're no longer the registered keeper, which protects you from any future fines or penalties linked to that car.

As the buyer, your job is just as vital. Never, ever hand over your money until you’ve seen the original V5C and are completely happy that every detail on it matches the car in front of you and the person selling it.

What the New Keeper Needs to Do

Once the deal is done, the seller will tear off and hand you the small green slip from the log book. This is officially called the V5C/2, or the 'new keeper's supplement'. Hold onto this; it's your temporary proof of keepership and it's incredibly important.

This little V5C/2 slip is your golden ticket to getting on the road legally. It has a reference number that lets you tax the vehicle immediately, either online or at a Post Office, long before the full log book arrives in your name.

You can expect your shiny new V5C to land on your doormat within about five working days. While the V5C shows the number of previous keepers, it doesn't really tell you their story. For a much deeper dive, you can learn more about how to check the previous owners of a car in the UK in our detailed guide.

For those in the motor trade, this entire process is just another Tuesday. It's a daily routine, and this is where AutoProv's AI-driven system really shines, helping dealerships manage this flow without a hitch. By pulling key data from the V5C, it helps get newly acquired vehicles advertised online with pinpoint accuracy, turning stock into sales faster than ever before.

Common V5C Pitfalls and How to Avoid Them

It’s surprisingly easy for small mistakes with the V5C to snowball into massive headaches. We’re talking hefty fines and messy legal problems. Knowing the common tripwires is the best way to guarantee a smooth, hassle-free vehicle sale or purchase.

One of the biggest red flags you can encounter is a seller who can't produce the original V5C. A missing log book should set alarm bells ringing – it could mean the car is stolen, has been written off, or has outstanding finance tied to it. Always, always insist on seeing the document and meticulously check that every detail matches the car and the person selling it.

Another costly mistake? Forgetting to tell the DVLA you've sold the car. If you're the seller, you are legally on the hook for that vehicle until the DVLA has officially processed the change of ownership. That means any speeding tickets or parking fines it racks up are your problem.

Distinguishing Keeper From Owner

Here's a point that trips up many people: the difference between the 'registered keeper' and the legal 'owner'. The V5C log book identifies the keeper—the person responsible for tax, insurance, and fines—but it is not proof of ownership.

For example, think about a company car. The business is the legal owner that bought and paid for the vehicle. The employee who drives it every day is the registered keeper. This distinction is vital, especially in private sales or when you’re digging into a car's history.

Your proof of legal ownership is a proper bill of sale or an invoice. This is another critical piece of the puzzle, as you can learn from our guide on the importance of finance checks for a vehicle purchase.

For dealerships juggling a whole forecourt of vehicles, these risks are multiplied. A single oversight on one car can lead to compliance nightmares and financial losses. This is exactly where an automated safety net becomes so valuable. AutoProv's platform is that digital safeguard for the motor trade. It automates these crucial checks, instantly flagging incomplete or dodgy data from the V5C and slashing the risk of human error. It’s about making sure every car in your stock is fully compliant and ready for a seamless, trouble-free sale.

Keeping Your Vehicle Details Current

Think of your V5C as less of a static certificate and more of a living document. It has to keep pace with changes to your vehicle and your life. Letting it fall out of date isn't just a bit of bad admin—it can land you with fines and other legal headaches. Any significant change needs to be reported to the DVLA, and quickly.

Whether you've changed your name after getting married, moved house, or made serious modifications to your car like swapping the engine or giving it a fresh coat of paint, the V5C needs to reflect that new reality. The process is straightforward: you fill out the relevant section on the log book, post it to the DVLA, and they’ll issue an updated version.

Scrapping, Exporting, or Replacing Your V5C

The log book also has a crucial role to play at the very end of a vehicle's life on UK roads. If your car is being scrapped or permanently exported, you must tell the DVLA by completing the designated section of the V5C. This is how you officially deregister it.

But what happens if the V5C itself is the problem? If your log book gets lost, stolen, or damaged beyond use, you need to apply for a replacement. You can usually do this online, and a new one typically arrives within a week.

An accurate, up-to-date V5C is the bedrock of legal ownership and compliance. With over 40 million vehicles registered in the UK, this single document is the backbone of the system tracking everything from road tax to MOTs. You can learn more about the scope of the V5C document's importance.

For dealerships, juggling this constant flow of vehicle data across a massive inventory is a serious operational challenge. Just as a private keeper has to maintain their V5C, a dealer must ensure its stock records are absolutely perfect. This is where a system like AutoProv becomes indispensable, helping to head off the costly compliance issues that pop up from out-of-date or incorrect vehicle information.

How the V5C Keeps Pace with Modern Cars

Think of the V5C as more than just a piece of paper; it’s a living document that has grown and changed right alongside the cars it represents. Over the years, it’s had to adapt to keep up with huge shifts in vehicle technology and environmental rules, especially when it comes to emissions. This evolution isn't just bureaucratic box-ticking—it's vital for both car keepers and the motor trade.

One of the biggest updates was the inclusion of far more detailed emissions data. This change tracks the industry’s major shift from the old NEDC testing standard to the much more realistic WLTP protocols, a process that really kicked in around September 2018. This isn't just trivia; the data logged by the DVLA directly sets a vehicle’s road tax (VED) band and is a huge factor in its green credentials. For a deep dive, you can explore the details of this data management on GOV.UK.

This move towards a more data-heavy logbook is part of a much bigger picture in the automotive world. As the V5C became more complex, the tools needed to make sense of all that information had to get smarter, too.

The V5C's data is no longer just for tax purposes; it's a key part of a vehicle's digital identity, impacting its valuation, desirability, and compliance.

This is exactly why platforms like AutoProv were born. They take this dense, complex data and turn it into something genuinely useful, giving forward-thinking dealerships the power to automate their marketing and stay compliant in a market that runs on data. It’s a crucial piece of the future of automotive technology in the UK.

Got Questions About the V5C?

Vehicle paperwork can feel like a bit of a minefield. To help you navigate it with confidence, here are some quick, clear answers to the questions we hear most often about the V5C document.

Your V5C Questions, Answered

How long will I wait for a new V5C? Once the DVLA has been told about the sale, your new V5C should land on your doormat within five working days. If four weeks go by and it's still a no-show, it's a good idea to get in touch with the DVLA just to make sure everything is on track.

Can I tax my new car without the full V5C log book? Yes, you can. When you buy a car, the seller is supposed to hand you the little green slip from the log book, officially called the V5C/2 or 'new keeper' slip. You can use the reference number on this section to get the vehicle taxed online, over the phone, or at a Post Office.

Is the V5C proof that I legally own the car? This is a really important one: no, it isn't. The V5C log book only shows who the 'registered keeper' is—the person responsible for taxing it and dealing with any fines. It is not legal proof of ownership. For that, you need a proper bill of sale or a receipt.

For professionals in the motor trade, keeping track of these documents for hundreds of vehicles is a daily reality. This is where services from AutoProv come in, helping to keep all these crucial administrative checks in order.

Frequently Asked Questions

AI-Generated Content Notice

This article was created with the assistance of artificial intelligence technology. While we strive for accuracy, the information provided should be considered for general informational purposes only and should not be relied upon as professional automotive, legal, or financial advice. We recommend verifying any information with qualified professionals or official sources before making important decisions. AutoProv accepts no liability for any consequences resulting from the use of this information.

Related Articles

Understanding the Consumer Rights Act 2015 in the UK Motor Trade

Explore the Consumer Rights Act 2015 and its impact on UK car buyers and sellers, offering essential protections and insights.

Understanding UK Automotive Regulations

Explore the complexities of automotive regulations in the UK, covering DVLA, FCA, MOT, and more.

Car Tax Guide for UK Motor Trades: Rates, SORN, and Compliance

Let's get straight to it. Vehicle Excise Duty (VED), or what everyone just calls car tax, isn't a tax on driving – it's a tax on owning a vehicle. For anyone in the motor trade, getting this wrong isn't just a bit of bad luck; it's a direct hit to your bottom line and your legal standing. Mastering the ins and outs of VED is non-negotiable.

Published by AutoProv

Your trusted source for vehicle intelligence