That used car you've got your eye on? It might look perfect, but it could be hiding a dangerous and expensive secret. Before you even think about handing over any cash, checking if it's a write-off is non-negotiable. This simple check from a provider like AutoProv is what separates a fantastic find from a financial nightmare. It’s about uncovering the car's real story, avoiding serious safety risks, and ultimately, protecting your wallet.

That used car you've got your eye on? It might look perfect, but it could be hiding a dangerous and expensive secret. Before you even think about handing over any cash, checking if it's a write-off is non-negotiable.

This simple check from a provider like AutoProv is what separates a fantastic find from a financial nightmare. It’s about uncovering the car's real story, avoiding serious safety risks, and ultimately, protecting your wallet.

Is That Used Car Hiding a Dangerous Secret?

Navigating the UK's used car market is tougher than ever right now. Modern cars are packed with complex tech, and with supply chain issues pushing up repair costs, insurers are increasingly deciding it’s cheaper to just write a vehicle off.

What this means for you is that more previously damaged cars are hitting the forecourts. And honestly, the quality of the repair work can be a real gamble.

This isn’t just a small shift, either. Between 2019 and early 2025, the percentage of vehicles declared a total loss shot up from 58% to 66%. Think about that for a second: for every 100 cars involved in an insurance claim, a staggering 66 are now written off. This trend highlights a stark reality for buyers – your chances of coming across a written-off car are higher than ever.

The Real Risks of an Undisclosed Write-Off

Buying a car without knowing its full history is a massive gamble. An undisclosed write-off could mean you’re driving a vehicle with deep-seated structural issues. Even if it looks immaculate on the outside, hidden damage can seriously compromise how it performs in a future accident, putting you and your family in danger.

And the financial fallout? Just as grim.

A car with a write-off in its history will nearly always be worth less, harder to insure, and a real headache to sell on later. Discovering this after you’ve bought it can leave you with a car that's worth a fraction of what you paid.

Why You Need More Than a Visual Inspection

A fresh lick of paint and a valet can hide a multitude of sins. That's precisely why you can't just trust your eyes. A proper investigation means digging into the car’s official records to see if it’s ever been involved in a serious incident. If you're starting from scratch, our guide on how to tell if a car has been in a crash is a great place to get some hands-on tips for your initial look-over.

This guide will walk you through everything you need to know to check if a car is a write-off. We’ll cover the essential steps, from making sense of salvage categories to using an AutoProv report to get the definitive story. With this information, you can buy with total confidence.

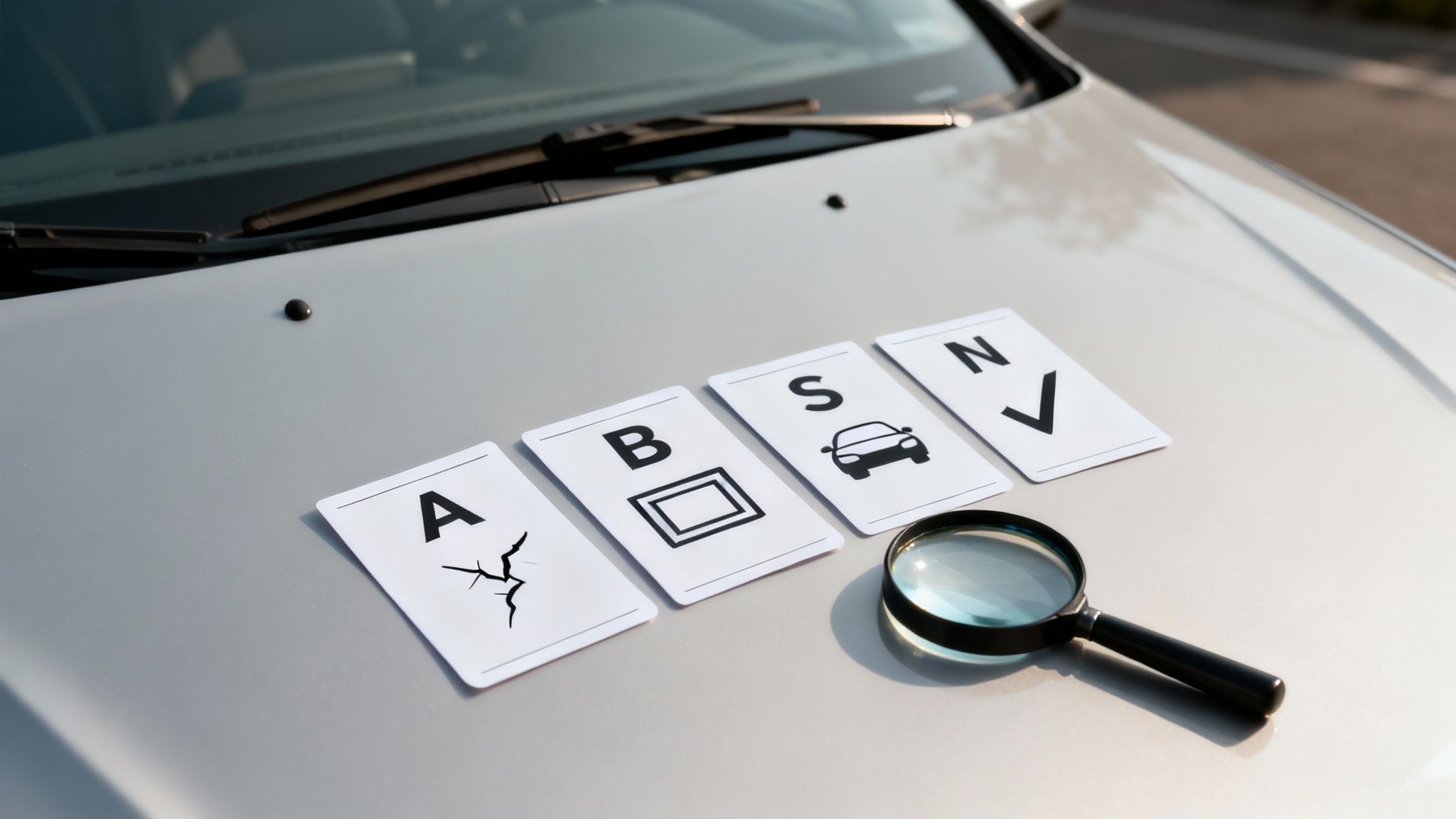

Decoding UK Car Write-Off Categories

Before you can confidently check if a car is a write-off, you first need to know what you’re looking for. It’s not just a simple "yes" or "no" answer. When an insurer declares a vehicle a total loss, they assign it a specific salvage category.

These codes are your Rosetta Stone for a vehicle's history report. Each one tells a crucial story about the level of damage and, most importantly, whether that car can ever legally see a UK road again. The system was updated back in 2017 to focus less on repair costs and more on the actual type of damage, which gives you much clearer insight.

The No-Go Categories: Stay Off the Road

Some cars are simply too far gone. If a vehicle has suffered extreme damage, it’ll be landed with one of the two most serious classifications. Spotting either of these on a report should be an immediate deal-breaker.

- Category A (Scrap): This is the end of the line, no exceptions. A 'Cat A' vehicle has suffered such catastrophic damage that it's only good for one thing: the crusher. Not a single part can be legally salvaged or reused.

- Category B (Break): The vehicle as a whole is a write-off, but a 'Cat B' means some of its parts can live on. You might find its engine, gearbox, or interior components for sale, but the bodyshell itself must be destroyed. That car is never getting back on the road.

Any vehicle flagged as Category A or Category B on an AutoProv report is a massive red flag. These cars are legally barred from ever being driven again for very good safety reasons. Accidentally buying one is a huge liability for any motor trader.

The Repairable Categories: Proceed with Caution

This is where things get a bit more complex. Categories S and N are for vehicles that can be repaired and put back on the road, but they come with different levels of risk that demand a closer look. If you want to get really deep into the details, check out our UK guide to insurance write-offs and what salvage titles mean.

Category S (Structural)

A 'Cat S' car has taken a hit to its core structural frame or chassis. We're talking about a bent or twisted chassis, a collapsed crumple zone, or damage to a major pillar.

Properly repairing this kind of damage isn't a job for any old workshop; it needs specialist equipment and highly skilled technicians. A botched repair can leave a vehicle dangerously unsafe, severely compromising its ability to protect anyone inside if it’s in another accident.

Category N (Non-Structural)

With a 'Cat N' vehicle, the key structural frame is intact. The damage here is typically cosmetic or related to other systems—think battered body panels, bumper damage, or faults with the electrics, engine, or suspension.

While it sounds less severe than structural damage, don't just dismiss a 'Cat N' status. The quality of the repair is everything. Poorly fixed electrical gremlins or other lingering issues can quickly turn into a nightmare of unreliability down the line.

Knowing what these categories mean is step one. The next crucial step is running a check that you can trust to find them in the first place, like the ones provided by AutoProv.

Putting Theory into Practice: Your Guide to a Vehicle History Check

Alright, you know what the salvage categories mean. Now it's time to roll up your sleeves and put that knowledge to work. Think of this as your practical playbook for digging into a car's past, starting with the basics and building up to the definitive checks that give you complete confidence.

Your very first move is simple but non-negotiable: get your hands on the V5C logbook. This document is the car’s official paper trail, and it's your job to play detective.

Start by matching the Vehicle Identification Number (VIN) on the V5C with the one stamped on the car itself. You'll usually find it at the bottom of the windscreen or on a plaque in the driver's side door jamb. Do the same for the registration number. If anything doesn't line up, it's a massive red flag.

Starting with the Free DVLA Checks

With the V5C details confirmed, your next stop should be the free online services from the DVLA. While they won't explicitly state if a car is a write-off, they provide crucial context that can hint at a troubled past.

The DVLA's online MOT history checker is a goldmine. It lets you see every MOT test result, including all passes, fails, and advisories. Be on the lookout for recurring mechanical problems or big gaps in the MOT history—this could mean the car was off the road for a significant time, maybe after an accident.

A quick tax check also confirms the car is currently registered and legal for road use. These initial steps are like reading the opening chapters of a car's story. They're fundamental for building a full picture, and you can get even more detail in our comprehensive UK buyer's guide on checking vehicle history.

The Critical Step: A Comprehensive Report

Free checks are a great starting point, but they only tell part of the story. They don't have access to the Motor Insurance Anti-Fraud and Theft Register (MIAFTR), which is the official insurance industry database where all write-off information is logged. To get the real answer, you have to go deeper.

This is where a professional-grade history check becomes absolutely essential. An AutoProv report is built for this exact purpose, pulling data from the same trusted sources used by motor trade professionals right across the UK. It cuts through the noise and delivers clear, definitive answers.

A comprehensive vehicle check isn't an expense; it's an investment in certainty. For a small fee, you uncover hidden problems that could otherwise cost you thousands in repairs, lost value, or legal headaches.

Our reports consolidate data from over 10 different sources to give you the complete picture in seconds. We go far beyond the basics to uncover the critical details that protect your business and your reputation. An AutoProv check delivers:

- Definitive Write-Off Status: Get an instant answer on whether the vehicle has ever been written off and see its official salvage category (A, B, S, or N).

- Outstanding Finance Agreements: Find out if a lender still has a claim on the car before you buy it.

- Police Theft Markers: Verify the car hasn't been reported as stolen on the Police National Computer (PNC).

- Mileage Discrepancies: We analyse recorded mileages from multiple sources to flag any signs of clocking.

Running an AutoProv check transforms your process from guesswork into a professional, data-driven assessment. You get the full, unvarnished history, empowering you to spot every hidden risk and make a truly informed decision.

What to Do When a Car Has a Write-Off History

So, the AutoProv report has landed, and it’s flagged the car with a write-off history. The immediate reaction for many is to walk away, but a Category S or N marker doesn’t have to be a deal-breaker. What it does mean is you need to change your approach and scrutinise the vehicle with a much sharper eye.

Finding out a car has been written off is where your real work begins. Your focus must now shift to understanding the original damage, verifying the quality of the repairs, and properly calculating the financial implications. This is more than just haggling for a discount; it’s about making a smart, calculated business decision.

Your Essential Question Checklist for the Seller

Once a write-off is confirmed, you need to ask some hard questions. Don't settle for vague answers or shrugged shoulders. The seller needs to provide clear, documented proof to back up everything they say. If they can’t, you’re essentially buying blind.

Your questions should be direct and methodical. Here's exactly what you need to find out:

- What was the exact nature of the original damage? Insist on seeing photographs of the car before it was repaired. This is the single most effective way to gauge how severe the incident really was.

- Who carried out the repair work? Was it a VAT-registered, reputable bodyshop with certified technicians, or a private job? Professional repairs will always come with detailed invoices.

- What documentation can you provide? You need to see invoices for all parts and labour. For a Category S car, you should also ask for a certificate confirming the structural alignment is back to the manufacturer's specifications.

If a seller gets defensive or claims they don't have this information, that’s a massive red flag. A transparent seller with a properly repaired vehicle has absolutely nothing to hide.

The Non-Negotiable Professional Inspection

Even if the seller hands you a folder bulging with paperwork, you can’t just take their word for it. The only way to truly check if a car is a write-off that has been repaired to a safe, roadworthy standard is to get an independent mechanical inspection. This isn’t an optional extra—it’s an absolute must.

A qualified inspector will go over the vehicle with a fine-tooth comb. They're trained to spot signs of poor-quality work like mismatched paint, inconsistent panel gaps, or overspray. Crucially, they’ll assess the integrity of any structural repairs and check for hidden mechanical or electrical issues stemming from the original accident. It’s a small investment that could save you thousands down the line.

Weighing the Price Against the Long-Term Risks

A write-off history permanently affects a car's value, and you need to understand how this impacts not just your purchase price, but your future customers too. A recent analysis revealed a growing crisis for UK motorists, with over 25% facing a shortfall of more than £3,000 between their insurance payout and the cost of a replacement car. This highlights why a written-off vehicle’s market value is permanently reduced, a fact you can learn more about by exploring the latest findings on the UK's car value gap.

This lower value has to be reflected in your pricing strategy. Insurers might also load the premiums for a previously written-off car, which can be a major turn-off for potential buyers. And remember, as a dealer, you have legal duties to your customers; our guide on the Consumer Rights Act 2015 in the motor trade covers these obligations in detail. Buying a repaired write-off can be a profitable move, but only if you balance the discounted price against these very real, long-term risks.

Why a Comprehensive Check Is Non-Negotiable

Let's be blunt: skipping a full vehicle history check is a gamble you just can't afford to take. It might feel like a savvy way to save a few quid, but the potential financial and safety fallout is massive. The reality is the used car market is awash with vehicles hiding a dark past.

Insurers are writing off cars at an incredible rate. Over the last five years, the UK has seen an average of more than 500,000 write-offs every single year. To put that in perspective, that’s a car being declared a total loss every single minute. With numbers like that, your chances of coming across one are much higher than you'd think, as recent insights on the rise in motor insurance claims highlight.

The Truth Is More Than Skin Deep

A fresh coat of paint and a polished exterior can hide a multitude of sins. Modern repair techniques are brilliant at masking shoddy work, but they can't magically restore a car's compromised safety structures or fix complex electrical gremlins lurking beneath the surface. This is where a proper, in-depth check from a specialist like AutoProv becomes your most powerful ally.

An AutoProv report is your ultimate safeguard. It isn't just another box to tick in the car-buying process; it's essential insurance for both your wallet and your peace of mind. Our reports dig far deeper than the free checks by accessing the official Motor Insurance Anti-Fraud and Theft Register (MIAFTR).

Think of it this way: a comprehensive check is the difference between making a confident, informed purchase and inheriting someone else’s expensive, and potentially dangerous, problem. It's the single most important investment you'll make before handing over your money.

Protecting Your Finances and Your Reputation

The risks go well beyond safety. An undisclosed write-off history torpedoes a vehicle’s value, making it difficult to insure and even harder to sell on later. But the problems don't stop there. Hidden issues like outstanding finance can drag you into serious legal and financial trouble. The importance of vehicle history checks for finance is critical, as it stops you from buying a car that legally still belongs to a lender.

Ultimately, a professional check from AutoProv gives you the concrete facts you need. It uncovers:

- Official Write-Off Status: Confirming if the car has a salvage history and revealing its exact category.

- Outstanding Finance: Protecting you from buying a vehicle with someone else's debt attached.

- Theft Markers: Verifying the car isn't flagged as stolen on the Police National Computer.

By investing in a proper check, you arm yourself with the truth. You get the power to walk away from a bad deal and protect your bottom line.

Frequently Asked Questions About Car Write-Offs

Even after you've done your homework, a few questions always seem to pop up when you check if a car is a write-off. It's completely normal. Let's tackle some of the most common queries I hear from buyers, so you can move forward with total confidence.

Can I Get Insurance on a Car That Has Been Written Off?

Yes, you can, but it's not always straightforward. For cars in Category S (structural) or Category N (non-structural), getting cover is usually possible, but you absolutely must tell the insurer about the car's history. If you don't, you risk voiding your policy entirely when you need it most.

Be prepared for higher premiums or a steeper excess. Some insurance companies simply won't cover written-off vehicles at all, so it’s crucial to get insurance quotes before you agree to buy the car. It's also worth remembering that cars in Category A or B can never be legally insured for road use again.

Will a Write-Off Always Show Up on a DVLA Check?

This is a common and dangerous assumption: no, it won't. The free vehicle information checker on the GOV.UK site is great for checking tax and MOT status, but it was never designed to show a car's write-off history.

While the V5C logbook is supposed to be updated if a vehicle is written off, this system isn't foolproof. The official, industry-wide record of write-offs is held on the Motor Insurance Anti-Fraud and Theft Register (MIAFTR). The only reliable way to tap into this database is with a proper vehicle history check from a service like AutoProv, which pulls together data from the MIAFTR and other critical sources.

A free government check only ever scratches the surface. To properly protect your money and your safety, you need a full report that accesses the official insurance industry records.

Is It Ever a Good Idea to Buy a Category N Car?

Potentially, yes—but you need to go in with your eyes wide open. A 'Cat N' car has suffered non-structural damage. This could be something as minor as cosmetic panel damage, or it could be a more complex headache involving the vehicle's electronics or cooling system.

If the repairs have been done to a high, professional standard, a Cat N car can be a real bargain. The catch is that the quality of that repair work is everything.

If you're even thinking about a Cat N vehicle, there are two steps you simply cannot skip:

- Get a full history check. An AutoProv report gives you the story behind the write-off so you can understand what you're dealing with.

- Pay for an independent mechanical inspection. A qualified mechanic can put the car on a ramp and properly assess the quality and safety of the repairs.

Without these two checks, you're buying blind. You could be taking on a car with deep-seated, expensive faults that will cause you nothing but trouble down the line.

Frequently Asked Questions

AI-Generated Content Notice

This article was created with the assistance of artificial intelligence technology. While we strive for accuracy, the information provided should be considered for general informational purposes only and should not be relied upon as professional automotive, legal, or financial advice. We recommend verifying any information with qualified professionals or official sources before making important decisions. AutoProv accepts no liability for any consequences resulting from the use of this information.

Related Articles

Essential Vehicle Checks Before Buying a Used Car

Learn essential checks to ensure your used car purchase is safe and sound in the UK market.

Why a Provenance Check is Essential for Used Car Buyers

Ensure your used car is a smart investment by understanding the importance of a provenance check and how AutoProv can help.

A Guide to Vehicle Check with VIN Number

A vehicle check with vin number is easily the most important thing you can do before buying a used car. Think of it as your first line of defence—a quick, simple step that pulls back the curtain on a vehicle's past, protecting you from expensive mistakes, legal headaches, and downright dangerous cars.

Published by AutoProv

Your trusted source for vehicle intelligence